M&A

Merge with and/or aquire another business

M&A (Mergers & Acquisitions) Advisory Service

Targeting SMBs (small to midsized businesses) with gross revenues typically between $500K and $10MM

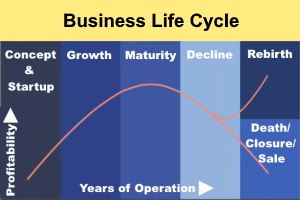

Business Life Cycle

All businesses, whether small, medium or large, follow a business life cycle that includes standard phases: Startup, Growth, Maturity, Decline, Rebirth/Innovation/Death.

The duration of each of the steps will vary depending upon various internal/external factors, but these phases always apply.

Why and when should you consider M&A?

A sale by one party may be an acquisition opportunity for the other.

There are several scenarios and reasons for your company to consider M&A:

- Growing your business by merging with or taking over a firm in a complementary business line

- Increasing market share by taking over a competitor

- A need for survival. If your business is declining, you may need to make hard decisions to ensure survival. Either partnering with other businesses or selling your business to others may be a better decision, instead of letting it die with a loss.

- Business restructuring. This is usually done to restructure equity and debt so that loans may cost less, thereby bringing in new acquirers or shareholders.

Why is it challenging to find M&A advisory firms?

- Their M&A requirements are smaller in size, meaning lower deal value and therefore less financial incentive for M&A advisors

- They may be looking for local/regional deals, and not many M&A advisory firms have the expertise to operate on the regional level

- The scope of the products and services to be acquired or spun off may be narrow, thus making an M&A more difficult

- The knowledge and perspective of the business owners may be limited

How can M&A advisory services help your businesses?

Purple Cow Capital can help. Charges and fees vary, but we can assist with:

- Identifying opportunities matching your expectations

- Selecting professional service providers, including legal, financial, and due diligence experts

- Valuation of the potential M&A deal, and establishing a fair price range

- Searching out, negotiating, and arranging financing for the deal

- Making an initial non-binding offer to the interested parties

- Negotiating the M&A deal on your behalf

- Structuring the transaction (this is critical!) and getting agreements from all parties

- Finalizing the terms of the deal

- Preparing an outline of the deal terms (note that the actual contracts must be prepared by legal counsel)

- Assistance with other necessary strategic decisions and schedules (when to publicly announce the deal, informing employees, vendors, etc.)

- Drafting a workable plan to integrate products and/or services, operations, etc.

Want to Know More About Our M&A Advisory Services

Please fill out the short form below:

M&A Inquiry

Location

4790 Caughlin Pkwy #204

Reno, Nevada 89519-0907

(+1) 775.376.2300

(+1) 800.901.2141

support@purplecowcapital.com